Make a difference

As a claims professional at COUNTRY Financial, you'll be there when our clients need us most. Whether you're helping fix a routine fender bender or providing support on the worst day of a client's year, you have the power to make a huge difference in our clients' lives. See just how rewarding that can be.

Meet the corporate claims team

- Auto Claims

- Casualty Claims

- Property Claims

- Crop Claims

From a minor fender bender to a major crash, our auto claims team analyzes the damage and gets our clients back on the road.

In the Total Loss Unit at COUNTRY Financial, we settle claims after a client or claimant’s vehicle has been deemed a total loss. Vehicle owners face a difficult time when their vehicle has been totaled. With every total loss assignment we receive, we have the unique opportunity to make a lasting positive impression. We do this by providing exceptional service while completing the process as smoothly and as seamlessly as possible to reach a fair settlement.

The Auto Field Appraiser is responsible for completing in-person inspections or photo of our client’s damaged vehicle, depending on which option best fits our client’s needs. In each situation the appraiser will assess the vehicle damage, prepare a detailed estimate for repair, then explain the estimate and repair process to the client. The appraiser also works with the repair facility to make sure all damages are identified and repairs are completed to industry standards.

The Auto Desk Appraiser is responsible for reviewing repair estimates for vehicles damaged in an auto loss. The appraiser will assess the vehicle damage, prepare or review a detailed estimate for repair, then explain the estimate and repair process to the vehicle owner. The appraiser also works with the repair facility throughout the vehicle repair to make sure all damages are identified and repairs are completed to industry standards.

In the Central Claims Office at COUNTRY Financial, we handle auto claims for personal and commercial lines, ranging from comprehensive losses, clear negligence, to complex liability and coverage investigations. Our adjusters manage their assigned claim load by completing full liability investigations and collaborating with other areas of the company and claims. Our adjusters work with the clients best interest in mind to promptly investigate claims and pay what we owe.

In the face of severe weather, our property claims team is there to provide clients with the support they need.

The CAT team travels to affected areas to evaluate, negotiate and settle personal and commercial lines property claims resulting from natural catastrophes. They investigate and complete physical inspections of property claims, evaluate damages and prepare written estimates according to policy provisions. They initiate the first contact with insureds and all relevant parties to gather basic information, obtain recorded statements and explain the overall claims process.

The Large Loss Unit travels to areas to evaluate, negotiate and settle personal and commercial lines property claims resulting from large claim loss. They investigate and complete physical inspections of property claims, evaluate damage and prepare written estimates according to policy provisions. They initiate the first contact with insureds and all relevant parties to gather basic information, obtain recorded statements and explain the overall claims process.

The Field Property Claims team investigates claims by determining applicable policy coverage and evaluate, negotiate and settle assigned claims. Team members initiate contact with insureds, claimants and all relevant parties to gather basic information, obtain recorded statements when necessary and explain the overall claims process. They complete physical and/or virtual inspections of damaged property when necessary, evaluate damage and prepare written estimates.

Desk Property Adjusters investigate claims by determining applicable policy coverage and evaluate, negotiate and settle assigned claims. They initiate contact with insureds, claimants and all relevant parties to gather basic information, obtain recorded statements when necessary and explain the overall claims process. They complete virtual inspections of damaged property when necessary, evaluate damage and prepare written estimates according to policy provisions and liability.

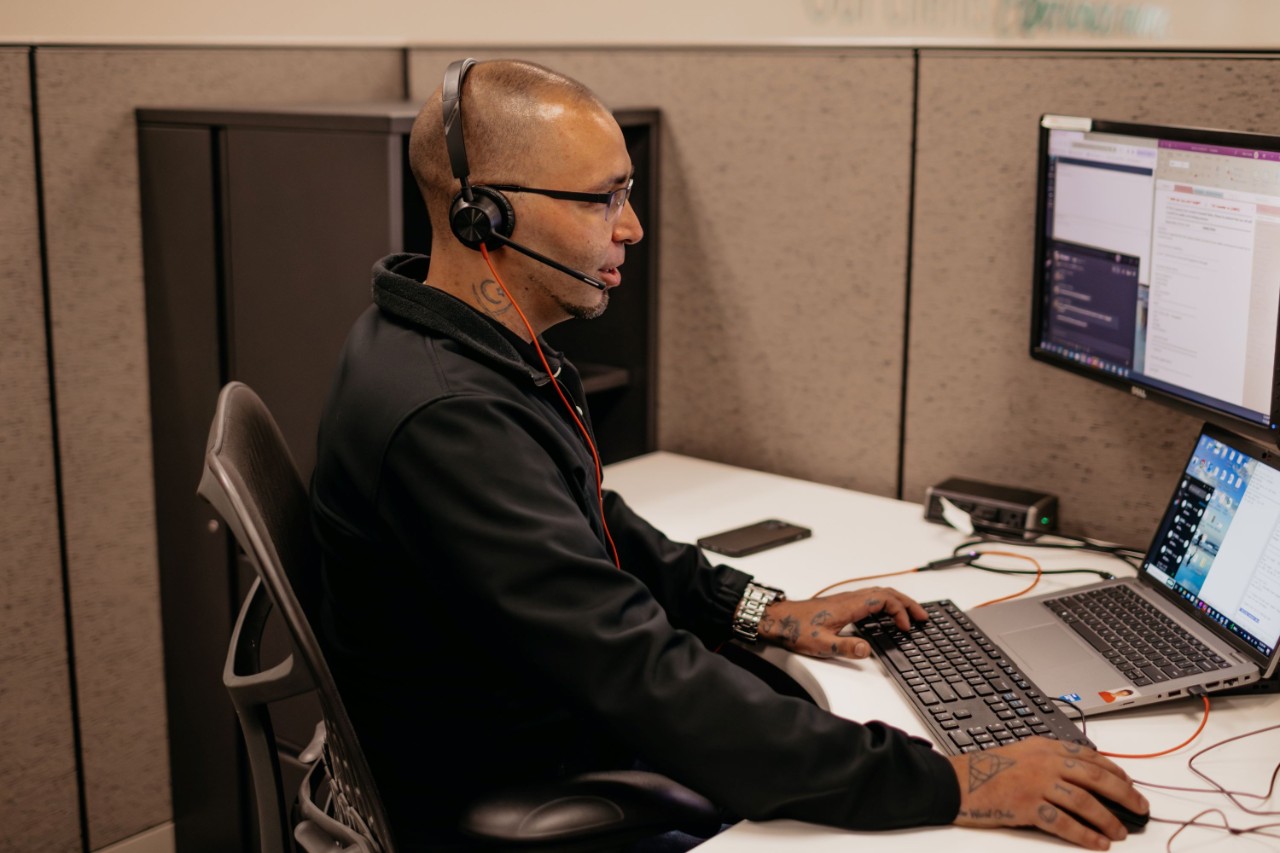

"I chose COUNTRY Financial because I wanted to work for a reliable company who cares about their customers, not just making a sale. The best part of working for COUNTRY is the work-life balance my job provides, and the flexibility of working in office or home."

-Adam Pemberton, Auto Claims Adjuster

How we help craft a more fulfilling career

We know you’re busy outside of work. That’s why we’re proud of our programs that support your work-life balance, including:

- Flexible hybrid work arrangements

- Paid time off to refresh and recharge, including paid volunteer time and a floating holiday

- Paid maternity/parental leave

- Dress for your day, with the option to wear business casual and jeans

When you work in Claims at COUNTRY Financial, a competitive salary is just the start. We offer:

- Annual bonus eligibility based on company performance

- Promotion opportunity within your first year

- Hybrid work after completing training and mentoring program

- Resource groups which allow you to connect with other employees about your interests and passions

- Group insurance benefits including, medical, dental, vision and more

- 401(k) with company-paid contribution and an additional match if you choose to contribute

We’re here to support you in your career journey as you accomplish your personal and professional goals. At COUNTRY Financial, we provide access to tools, training, mentoring and more including:

- Tuition Assistance Program – Receive financial support toward college-credit earning educational experiences to enhance your career development

- Industry designations –Contribute to the success of the organization and grow your confidence and knowledge to best serve our clients

Diversity, equity and inclusion increases our capacity to better serve our clients’ unique needs in the communities in which they live, work and play. Here at COUNTRY Financial, we:

- Know we do our best work when our employees and reps are engaged, respected and connected

- Intentionally work together to create a culture and environment where all talents, experiences and backgrounds are valued for their contribution and role in achieving success

- Aim to best serve our clients by integrating inclusion as a business approach, reflecting the diversity of the marketplace and embracing diversity in a way that engages everyone

- Strive to fill employee and rep positions with top talent from diverse backgrounds to achieve our clients’ version of financial security, no matter their starting point

Claims apprenticeships

COUNTRY Claims Apprentices launch a rewarding career while earning college credit.

Paid tuition

All Claims apprentices who successfully complete the apprenticeship will earn the Associate in Claims designation as part of the program. They can also take advantage of our tuition assistance program and work towards a degree if they choose.

Full salary and benefits

Apprentices earn while they learn with a competitive salary and full benefits, including health, dental, and life insurance, 401K, access to career and mental wellness resources and more!

Interactive training

In addition to classroom training, apprentices learn through guest speakers, job shadows, mentoring, and on-the-job experience.

Endless possibilities

Second year apprentices will choose a specialization track in Auto, Casualty, or Property to take their career even further. Careers in Claims offer excellent earning potential and limitless opportunities to learn, grow, and experience more.

Ready to take the next steps?

Interested in learning more? Apply today and join our talent community to stay up to date on all things Claims at COUNTRY Financial!

COUNTRY Financial® is a family of affiliated companies (collectively, COUNTRY) located in Bloomington, IL. Learn more about who we are.

COUNTRY Financial® is an Equal Opportunity Employer.