Market and Economic Outlook - Released 6/30/24

Key Takeaways:

- The Federal Reserve’s ability to achieve a soft landing is uncertain, but current market conditions suggest caution and a preference for bonds over stocks.

- We are aligning allocations more closely to the overall U.S. stock market reducing overweighting to small and mid-cap stocks and increasing large caps. We prefer international developed market stocks over emerging markets.

- Investment-grade bonds remain attractive for long-term investing due to their potential for comparable returns to stocks but with less volatility.

Investing involves making educated guesses about the future. However, no matter how much data or sophisticated the models, these forecasts are never 100% accurate. Warren Buffett once said, “Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future.”

Over the last few quarters, we have taken a cautious approach to multi-asset portfolios. We feel investors are not being adequately compensated for taking on the higher risk of stock investing when compared to less volatile investments like investment grade bonds yielding near 5%.

Over this time, the S&P 500 has moved higher. Massive capital investments in Artificial intelligence (AI) technology have accompanied rapid stock market gains in ways reminiscent of past tech booms. Investors are trying to determine if the fervor surrounding AI can continue or is there potential for overinvestment leading to a bust soon? Adding to the ambiguity are questions about the trajectory of inflation, speculation about Federal Reserve interest rate cuts, the lagged impact of rate increases on consumer spending and an election looming in the U.S. Given all these factors, it is safe to say that strategizing portfolio positions for the upcoming months is, at the very least, a formidable task.

Instead of aspiring for a perfect prognostication, we look to understand the inherent uncertainty and make investment decisions for a range of outcomes. Over the long term, we believe this will best serve our clients.

Bifurcated Quarter

The first quarter saw breadth enter the U.S. markets with companies outside of the S&P 500 participating in the upswing with mid-cap stocks keeping pace with their larger cap peers. Small-cap stocks, while not quite catching the same bid, still saw a healthy 5% move upwards. This quarter was a story of bifurcation between those markets. The S&P 500 rose 4.3% while mid and small-cap stocks were down 3.5% and 3.3%, respectively (more specifics on the stock market below). International developed markets were flat on the month while emerging markets enjoyed a 5.1% lift. Investment grade bonds were flat while lower quality bonds continued their upward climb (Figure 1).

Figure 1

Figure 1

State of the Consumer

Consumer sentiment fell in the second quarter according to the University of Michigan’s Consumer Sentiment Index. This fall in sentiment seems to be a mismatch with what we see going on economically. Some data shows signs of a cooling, but still solid, economy while other data points continue to show up strong. Weekly jobless claims have trended up with the 4-week average climbing from 214,500 claims at the beginning of the quarter to over 230,000 claims to end the quarter and back to levels last seen in September of last year. Job openings have fallen by over 700,000 since the beginning of the year to just over 8 million openings. The consumer is also slowing their pace. Gross domestic product (GDP) is estimated to have grown at a 1.4% pace in the first quarter with consumer spending increasing by 1.5%, which is slower than the fourth quarter 2023’s 3.3% growth but is still a healthy pace.

Non-farm payrolls, on the other hand, continue to be a bright spot. Payrolls averaged 218,500 jobs created per month in April and May, which was lower than the average in the first quarter, still points to a solid U.S. economy. Purchasing Managers Indices (PMI) also continue to point to growth in the U.S. with services in the driver’s seat.

Fed Watching

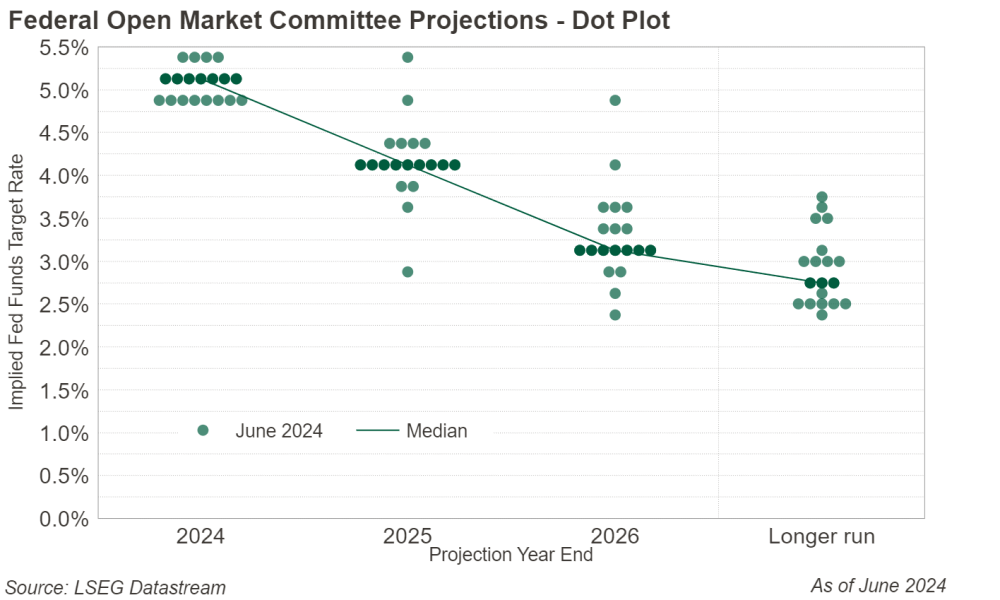

The Federal Reserve (the Fed) remains waiting for additional data to move off their current interest rate policy range of 5.25% to 5.5%. The Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) have been falling over the past year, which is what the Fed would like to see, but it has been a bit bumpy as of late. In their most recent projections, they now expect there to only be one or two cuts to the fed funds rate this year with the market anticipating the first one to come as soon as their September 17-18th meeting (Figure 2).

Figure 2

Figure 2

Whether the Fed can engineer a soft landing remains to be seen, and our team will continue to monitor the data as we move along. Markets are pricing in a soft landing and the stock market is not giving reason to take on additional risk currently. We continue to exercise caution and maintain a slight preference for bonds over stocks.

A Tale of Two Quarters

The S&P 500 Index rose again in the second quarter returning 4.3%. While the first quarter rally of 10.6% saw most sectors contributing with strong positive returns, we saw a far narrower breadth of contributing sectors in the second quarter which was led by information technology, communication services, and utilities (Figure 3). These sectors could at least partially point to AI as contributing to their performance during the quarter as investors flocked to communication services and information technology companies that are deeply tied to evolving technologies like AI. The utilities sector, which has underperformed in recent years, may benefit from growing electric power demand required by data centers that are supporting the AI buildout.

Figure 3

Figure 3

Frenzy for AI

We believe that strong market interest in AI may continue for the near future, which could provide continued momentum for stocks linked to these trends. Shares of Nvidia Corporation continued to surge throughout most of the 2nd quarter and it has increased its market capitalization by over $1 trillion dollars during the quarter. Nvidia, previously better known for their graphics processors, has leveraged their advanced computing technology to more efficiently develop and train new AI models. Their expected future growth due to the AI buildout has generated strong investor interest. The stock price hit its all-time high in mid-June, briefly surpassing Microsoft as the largest company in the world as measured by market capitalization (Figure 4). This quickly reversed over the next few trading days resulting in the stock price falling by over 12% from its intraday peak by the end of June. This is just one recent example that share prices in even some of the strongest stocks can be highly volatile for any number of reasons whether logical or not. Examples like this are why we also believe it is prudent to maintain responsible position sizes and not allow soaring returns to cause us to lose sight of risk management principles.

Figure 4

Figure 4

Sizing Things Up

We also continue to maintain exposure to diverse areas of the market, such as international stocks and small and mid-cap stocks. While we still find these sectors appealing from a valuation perspective, it is important to acknowledge any potential outperformance may depend on a shift in recent market trends. As a result, we feel it makes sense to reduce overweighting to small and mid-cap stocks and increase large caps, aligning allocations more closely to the overall U.S. stock market. We remain neutral regarding international stocks while maintaining a preference for developed market stocks over emerging markets. Our goal is to allocate client assets to areas of conviction within the equity markets, while also considering a wide variety of possible outcomes.

Inverted Curve

The persistence of inflation has led bond investors to anticipate the Federal Reserve will maintain its current stance throughout the summer. This expectation has kept short-term rates elevated and resulted in the longest-ever inversion of the Treasury yield curve (Figure 5). An inverted yield curve means that shorter-term interest rates are higher than longer-term interest rates. As monetary policy and economic conditions normalize over time, the yield curve will eventually slope upward again but timing remains uncertain.

Figure 5

Figure 5

Total Returns and Coupon Clipping

With the inverted curve, we feel it is prudent to invest more broadly in a diversified fixed income portfolio rather than simply collecting income. Our philosophy is to focus on total return considering income from interest payments as well as gains through the bond’s potential price appreciation.

Within a total return approach, understanding the interplay of bond components is crucial. Investors often confuse bond coupon payments with yield. Fluctuating interest rates and credit spreads, or the difference in the yield of two bonds with the same maturity, affect bond prices. Bonds trade at a premium or discounted price based on their coupon rates relative to current market rates, which influences their yield. While investors receive distributions of the bond’s coupon, the total return also includes price movements of the bond.

For instance, as of June 30, the Bloomberg U.S. Aggregate Bond Index had a yield to maturity of 5.00%, while the weighted average coupon was 3.35%. This discrepancy highlights the potential for capital appreciation in bonds trading below face value, a result of historical rate increases in the last few years. Currently, many bonds are trading below face value, indicating returns are primarily driven by principal repayment at maturity rather than income. Bonds with low coupons trading at significant discounts to face value may offer opportunity in today’s market.

Value in Bonds

Investors are now contemplating whether to invest in cash or short-term CDs instead of intermediate and longer-term bonds since the Fed is unlikely to cut the federal funds rate significantly. While cash may be appealing for short-term objectives, the potential of fixed income investments remains attractive for long-term investing. We believe investment-grade bonds are currently priced to yield returns comparable to stocks, but with less volatility. To complement the core bond position, we also allocate to higher-yielding sectors including floating rate loans, preferred stocks and emerging markets bonds as fundamentals remain broadly supportive.

While credit spreads remain low, the real return in bonds is positive with inflation near 3% and the yield to maturity on the U.S. investment grade bond market around 5% at quarter end. The current real yield on investment-grade bonds lays a solid foundation for performance in a robust economy and could lead to even better results if a slowdown prompts the Fed to reduce interest rates. The starting yield is a reasonable predictor of what you will earn over a multi-year holding period but, as we have seen so far this year, bond market total returns can deviate from current yields in the short term.

The Bottom Line

The current economic landscape presents a complex picture. While there are signs of stress among lower-income consumers, overall economic growth remains positive. We continue to favor a cautious approach, maintaining a bias towards fixed income within multi-asset portfolios. While forecasting is exceedingly difficult, a portfolio able to withstand a variety of macroeconomic environments coupled with a financial plan can go a long way to achieve successful investor outcomes.

Figure 6

Figure 6

*Forecasted average annual returns of COUNTRY Trust Bank Wealth Management

Source: Morningstar and COUNTRY Trust Bank® - See Definitions and Important Information below

COUNTRY Trust Bank® Wealth Management Team

- Troy Frerichs, CFA - VP, Investment Services

- Jeff Hank, CFA, CFP® - Manager, Wealth Management

- G. Ryan Hypke, CFA, CFP® - Portfolio Manager

- Beau Lartz, ChFC® - Investment Analyst

- Cody Behrens, ChFC® - Investment Analyst

- Emily Meldrum - Investment Analyst

- Chelsie Moore, CFA, CFP® - Director, Wealth Management & Financial Planning

- Kent Anderson, CFA - Portfolio Manager

- Jonathan Strok, CFA - Portfolio Manager

- Michelle Beckler - Investment Analyst

- Samantha Reichert - Investment Analyst

Looking for help navigating your future?

Set up a meeting with your local rep to review your current policies and make sure they're up to date. We pulled together some less obvious reasons to adjust your coverage.

COUNTRY Financial® is a family of affiliated companies (collectively, COUNTRY) located in Bloomington, IL. Learn more about who we are.